Want to learn how to retire early? Here’s my exact plan you can follow.

In “Dark Knight”, the second installment in Christopher Nolan’s masterful Batman reboot, Heath Ledger, playing the Joker, scared the shit out of me with his insanely mesmerizing performance. Certainly, one could argue his portrayal goes down as one of the greatest villain-acting jobs of all time.

At one point in the film, Harvey Dent, Gotham City’s District Attorney, accuses the Joker of carrying out an evil plan. The Joker says, “Do I really look like a guy with a plan? You know what I am? I’m a dog chasing cars. I wouldn’t know what to do with one if I caught it!”

He adds, “You know, I just… do things.”

That’s the problem with most investors. They just… do things. And they don’t know what to do when they “catch” a deal.

I interact with multiple people every week who desire to build wealth. Many ask for advice on what they should do with their hard-earned capital. Do they buy stocks? Do they choose ETH as the crypto to take a chance on? Do they buy a home, judging by the market right now? Do they focus on more real estate?

But there’s one problem.

While these are all important questions that should be considered in building your financial goals, they are only tactical ones. Where’s the strategy?

Table of Contents

Where’s The Strategy?

Imagine if the United States military, by far the most powerful fighting force the world has ever seen, went into battle relying on their superior weapons and overwhelming numbers of soldiers, without any regard for coordinating their air force, navy, and ground forces.

Well, that’s what the Russians just did in Ukraine, and they got their asses kicked by a much smaller, far less equipped fighting force. The Russians thought their overwhelming advantage in tanks, ammo, artillery, and planes would be enough to take Kyiv, the capital of Ukraine, in a matter of days.

They overlooked one thing: These were only tactical advantages.

And Russia absolutely got pummeled, to my delight. (I love reading the updates of when Ukraine kicks its authoritarian ass.)

Russia’s strategy was so terrible and uncoordinated that they lost more soldiers in the first 3 months of the war than they had in 20 years of fighting in Afghanistan.

The retired US Generals who provide commentary on the war seem to all agree: the Russians did not effectively combine their air, ground, and sea forces together and missed a lot of opportunities to knock out critical infrastructure ahead of their advance.

My point?

Here’s the thing: Some will succeed without a sound strategy. But there are slim chances of everything going right without a plan.

It’s all luck, and do you really want to depend on luck while investing? That’s not a reliable step at all when it comes to protecting your assets, creating passive income, and growing multi-generational wealth.

My goal is to teach you how to create downside protection, predictable cash flow, and outsized growth. To get here, you have to do a bit of thinking. Thinking is by far the hardest work we’ll ever do, and it’s why so few humans really engage in it.

I found out how hard thinking is when I decided to build the Indestructible Wealth platform, which relies heavily on me producing a steady stream of thought based leadership and a content based approach.

I sit here in my living room chair with my laptop and my cute little Goldendoodle snuggled up next to me (hey, did I just lose my ManCard?), and all I do is think about how I can add value to my current and potential audience, and it’s the hardest work I’ve ever done.

In fact, if I’m tired from traveling, I’m absolutely worthless in getting anything done on this brand, because thinking requires a great deal of energy and revitalization.

So with that being said, let’s think about our overall strategy for how to retire early. Then we can start implementing the tactics of picking which investments fit that plan.

How to Retire Early: 5 Stages Of Building Indestructible Wealth

STAGE 1: Invest in YOU

Increase your knowledge and skills to increase your earning power.

I believe that the most critical but often overlooked step is to put your money into developing your own mind. I have yet to see any investment that can provide the type of return as developing your skills and knowledge to increase your earning power.

The problem that we have with it is that we can’t quantify it. Normally, when you buy an asset, or invest into your business, you generally know what the return is. When your stock goes up by 15%, you have clarity on that invested capital’s performance. You can calculate it.

When you spend money on advertising, you generally get a pretty good idea if it worked and what kind of impact it made on your revenue. Because they’re all numbers.

I can’t tell you what kind of return I’ve received from all of the books I’ve read, the courses I’ve taken online, the seminars I’ve been to, or the coaches I’ve hired. I have no idea. Yet I know that if you took all of those things away, and they were never a part of my investment plan, that I wouldn’t be even close to where I’m at today, in terms of both earning power and investment returns.

Although I tell the tough story of losing half my hard-earned college hustle money in the market, I also during that same time frame went to over 20 sales and personal growth seminars (in addition to my college classes), and read the classic “Think and Grow Rich”.

I ended up spending $1,000 on private coaching with the Napoleon Hill Foundation, because that’s what normal college students do with their money.

Those seminars and private coaching sessions helped me dial in my business strategy and increase my capacity to be able to handle more than average at a young age. I know that 25 years later, today, I still dwell on what I learned and how they changed my thoughts and beliefs.

Surprisingly, my message of prioritizing “You-based investing” is polarizing. I created a short social video that explained this concept and it was met with a lot of praise, and a lot of people cussing me out. I guess this doesn’t fit their narrative, they’d rather hear “Invest $1,000 into Shiba Inu and turn it into $100,000 in no time!”

STAGE 2: Invest into building a cash flow producing business

In addition to investing into yourself, I’m strong on investing your initial capital into starting and growing your own cash flow producing business.

After it was apparent that I wasn’t going to get rich quick in the stock market, I turned my attention to what I could control: I could directly influence my wealth creation through aggressively building up the earning power of my own business.

I know it’s no easy task, but there isn’t a faster way to grow wealth than by growing your own business. The advantages are just too strong:

- Pay far less than employees in taxes

- Create passive income through people at work

- Build equity as the profitability improves

Most business owners forget how valuable their own companies are. Businesses are valued based on their earnings, or net profit. The profitability is what entices the next guy to want to buy yours.

Most private businesses are sold based on a multiple of the earnings, typically 300% to 500% of their earnings. So if your business produces $100,000 in net profits per year, then it’s probably worth $300,000 to $500,000 or even more. My next door neighbor’s family sold their private business for 19x earnings!

You may have a business you’ll never sell. I do. However, that doesn’t mean that just because I don’t want to sell it, that it doesn’t have value and increase my net worth. A lot of business owners look at the other assets they own outside of their primary business and feel down about it, not ever really considering their biggest asset counts.

STAGE 3: Live below your means

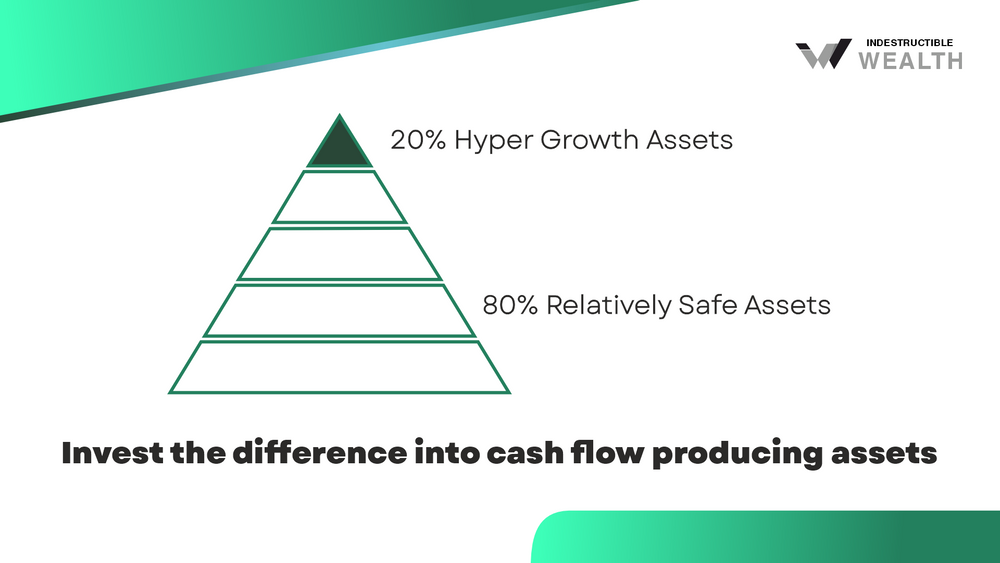

Then invest the difference into cash flow producing assets.

To truly build long-lasting wealth, you need to generate multiple, reliable streams of income, in addition to your riskier strategies. It may seem paradoxical, but the more “safe” income you build, the more “free” income you’ll have to speculate on high-risk, high-reward plays.

But first, you must build the base of your wealth on a solid foundation of multiple income streams. This income strategy can help you generate 15%, 20%, even 30% or more, per year, on your money, safely.

Some of you will use that extra money to make more life-changing, higher risk, higher reward “cryptotype” plays, without risking your current lifestyle. Others will use it for dream vacations or second homes. And I’m sure many of you will be able to use this income to pad your retirement nest eggs.

The point is that when you have steady income coming in, separate from your employment or main source of income, you’ll have so many more choices in your life. You can spend money on your hobbies without guilt. You can buy your spouse expensive gifts without the nagging worry of a credit card bill looming in the back of your mind.

When you have more money coming in than going out, every aspect of your personal life will improve. That’s what I designed the Indestructible Wealth Method to do: Provide streams of income that you can invest or spend on whatever you want, whenever you want, guilt-free.

My recommendation is that around 80% of your initial principal capital, typically your first $100,000, is placed into relatively safe assets that kick off passive income.

I use the word “relatively” safe because if you’re too conservative and only go for fixed income assets, then you’re going to miss out on also growing the overall value of your portfolio. I like assets that give me solid streams of predictable cash flow AND have a chance of growing in value.

Not sure what your options are for this? I created a free guide with 12 options that are immediately actionable. I lay out the risk profile, expected returns, and what type of investor these would be good for.

Don’t let the free price tag conceal the true value of this report – it’s priceless. If I had this when I was getting started, I’d be lightyears ahead of where I am now. The other 20%? Go for growth, which I’ll lay out for you now in Stage 4.

STAGE 4: Invest your income from stages 1, 2, and 3 into hyper growth assets

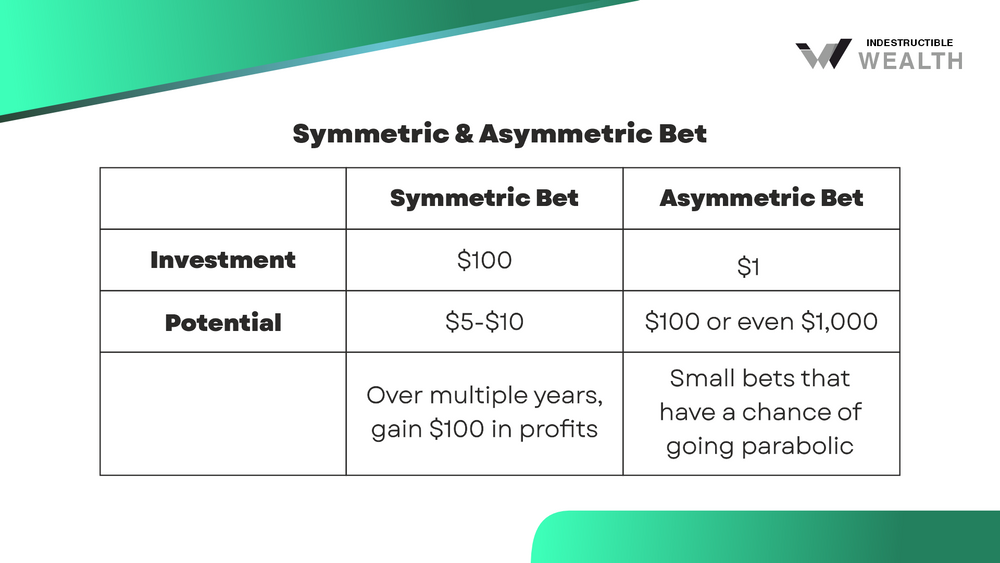

By taking the cash flow from these investments and moving it into “asymmetric” bets, we are yet again reducing our risk. If they don’t work out, and certainly several of them will not (that’s the price you pay for early stage investing), then your cash flow replenishes the next month(s), and you can move on to the next early stage high growth bet, with your lifestyle unaffected and your principal capital protected. Symmetry is where it’s equal on both sides. Let’s take a look at the two terminologies.

A symmetric bet is where you put in $100 and you’re going for $5-$10 type gains on that $100 to at some point, over multiple years, get $100 in profits.

Asymmetric bets are when you invest $1 with the potential of $100, or even $1,000 returns on your dollar. These are small bets that have a chance of going parabolic. These are almost entirely made up of early stage projects such as pre-IPOs (Initial Public Offerings), crypto alt coins (everything but Bitcoin), and early-stage technology or growth stocks.

I help investors navigate this crazy world and provide multiple options of some of the most promising companies in my Premiere Mastermind group. It’s a small group of serious wealth builders that want access to world class research and weekly livestreams with unlimited Q & A with me. Interested? Book a call right here.

When you focus exclusively on producing cash flow, you miss out on some huge potential gains in your wealth. Personally, at one point I became so focused on creating cash flow that I pretty much ignored anything that could be considered even the least bit speculative.

I wanted to only buy investments that I knew, so that when I bought them, I could predict what the return on investment would be. Me being me, I became hyper-focused once I made my mind up, and couldn’t spot any other opportunity at all.

One day, I was helping my wife out at our nutrition club, whipping up high energy teas and healthy smoothies for customers, when in walked Lance the landscaper. We got into a conversation about Bitcoin and cryptocurrency.

Lance told me that he bought 10 Bitcoins back when it was $1,000 per coin. On the day we were talking, 1 Bitcoin was worth $20,000, and quickly thereafter jumped to as much as $58,000.

Lance the struggling landscaper had invested $10,000 and turned it into over $500,000. That was the moment I knew that I HAD to change my mindset. It was time to stop grinding out only small and predictable returns. It was time to start going after some exponential returns.

STAGE 5: Start giving to charity

Last year, someone asked me what my greatest accomplishment was. I responded, “Without a doubt, it’s the connected, amazing relationship I have with my wife”.

Apparently, that wasn’t at all what they were expecting. I’m sure they figured I’d name off a business accomplishment or a financial gain knowing that I’ve achieved some success in those areas.

But I’d like to change my answer.

After having more time to think about it, I want to add one more thing to my greatest accomplishment list.

That I’ve given over $250,000 to my Church.

When my wife and I first started giving, we were definitely not wealthy. Our overall net worth was under $500,000 at that time. It wasn’t easy to start. Just like going to the gym after a long break, your muscles are weak and it’s tough.

Over time, though, as you continue to build the muscle it gets easier, but never gets easy. The same concept applies with charitable giving. At first, it’s extremely difficult to part with your cash when you want it for yourself. I used to think, “I’ll start giving once I’m a millionaire and have everything that I want.”

What’s so unique about the way life is designed by Infinite Intelligence is that we really don’t get what we want until we help others get what they want.

This proves true in business too. If you want to grow your income and reach your goals, you need to be focused on helping other people solve their problems first.

Since we started giving, it’s been truly incredible to watch how we’ve been increased and blessed. Our income has gone up by triple and our net worth has grown by more than 10x.

That’s why I always say that givers always gain.

Wrapping It Up

So if you want to build indestructible wealth, start by enhancing your knowledge. As you earn and establish a business, start putting money into it itself. This multiplication will give you a stronghold. Next, focus on cash flow producing assets but parallelly and slowly, start venturing into hyper growth assets. Once you’ve gained stability, practice giving. Donate whatever amount will make you happy. That’s the real secret to financial success.

Whenever you’re ready, there are 3 ways I can help you level up your finances:

- Take an affordable self-learning e-course: COMING SOON

- Take our new interactive course The Indestructible Wealth Academy to help you buy ten cash flowing properties within two years, with the goal to create a million in equity: COMING SOON

- Ready to invest your money?

→ Buy cash flowing, turnkey real estate. It’s acquired, renovated, and managed for you by my company, High Return Real Estate.

→ Wish you had bought bitcoin back at $12,000? Now you can with my company Simple Crypto Mine. We provide the machines, the hosting, the technical expertise, and the maintenance. Watch bitcoin drop in your wallet every five days for another stream of passive income. Email me at [email protected] to request the investor packet.

→ Are you an Accredited Investor with larger amounts of capital to invest? Syndicated deals in self-storage and car washes are 100% passive and very lucrative. Email me at [email protected] to request the latest investor replay to learn more!